Amidst the pandemic collapse and chaos, Indian retailers and wholesalers have something to rejoice. The Union Government has announced revised guidelines by which retail and wholesale traders are now eligible to be registered as MSMEs. This move is set to benefit millions of retailers and wholesalers who can now get access to bank loans, priority sector lending and a host of other benefits.

MSMEs are the second-largest employment creator in India with the first being the mother of Indian employment – agriculture. According to the National Sample Survey 73rd round there are an estimated 6.30 crore MSMEs. They provide employment to 11 crore people in India (~27.5% of the total workforce) that is every fourth employed Indian is in a MSME. They contribute 30% to the GDP and account for 48% of exports. With the new Government notification, around 2.5 crore traders are to be added to the MSME list.

The Government’s move would be a major boost to small retailers and wholesalers, especially since this has been a request made by them since last year. Needless to say, retail and trade associations have welcomed the move. They feel it will enable traders to get access to much-needed capital having been impacted badly thanks to the covid pandemic. Several measures announced for the MSME sector over the past year will now be applicable to retail and wholesale traders as well. Confederation of All India Traders (CAIT) have welcomed the move.

Wholesale and retailers will now be eligible to avail various schemes announced for the MSMEs to get access to funds and tide over the covid19 impact. They can now avail of priority sector lending. As per the RBI’s guidelines, commercial banks should extend 40% of the total lending towards priority sector. Regional Rural Banks and small finance banks have to extend 75% of their total lending towards the priority sector.

They get a 2% interest reduction for all GST registered MSME on incremental credit. There is also an increase in interest rebate of 5% for exporters who receive loans in the pre-shipment and post-shipment. Central Public Sector Undertaking will make mandatory procurement of 25% from MSME. And there is good news for traders who are women. Out of the 25% mandatory, 3% is reserved for them.

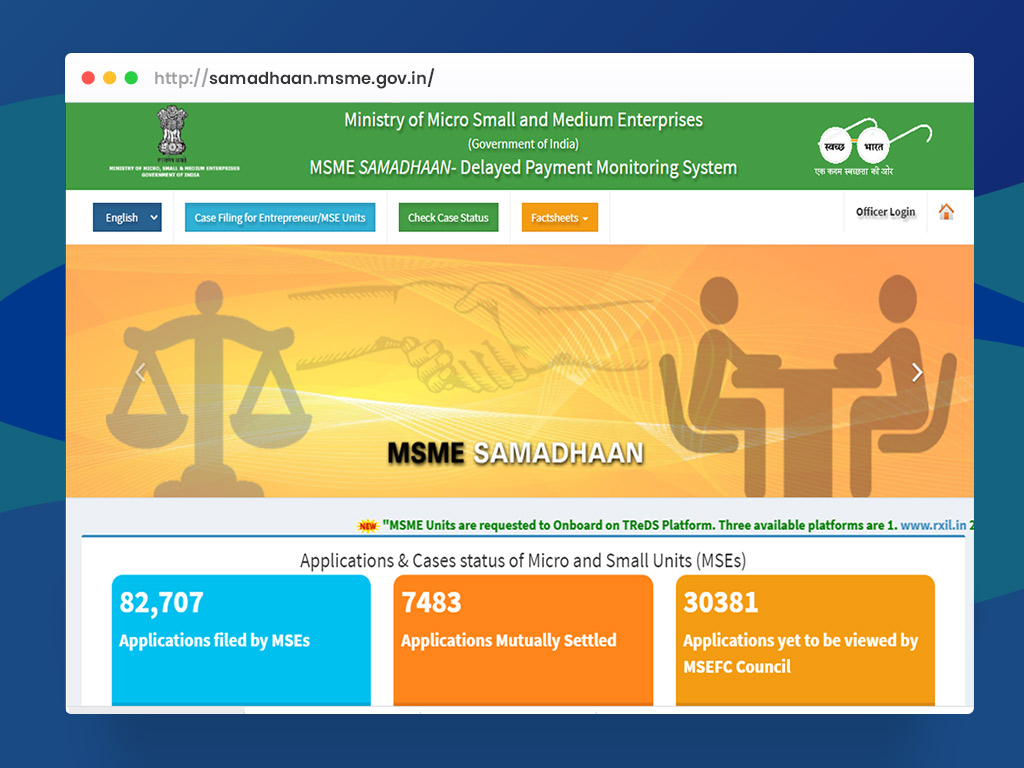

They can resort to MSME Samadhan – A Portal created to file and report delay in payments beyond 45 days. The portal has been very helpful for many MSME suppliers to collect their overdue payments.

Also, retailers and wholesalers can enjoy registration in Udyam portal – the free, paperless online and instant registration portal. The Udyam portal provides a single-page registration, consumes less time, and simplifies the process of registering any enterprise under MSME category. Once registered, they are eligible for a host of benefits, like getting interest rate subsidy on bank loans, exemption under direct tax laws, concession in electricity bills etc. MSME’s are encouraged to get onboarded to the Government e-marketplace (GeM) portal through a simplified procedure by providing a button in the Udyam registration online form.

As is the case with life, the upsides have their downsides too. Adding 2.5 crore traders to an already bulging 6.3 crores is going to inflate problems to the sector and dilute MSMEs who have been crying for help.

Once retail and wholesale traders get included in the priority sector lending category under MSMEs, bankers may prefer to lend them rather than to small manufacturing units. MSMEs may claim traders don’t need as much funds as a manufacturing unit does. Now that the government has increased the pool, it should ensure the funding pool is increased as part of the finance budget since adding more MSME’s will require more support and hand-holding on growth funding.

The Government should set a policy of categorization of lending to various sectors in MSME. Manufacturing, Trading, Services can be allotted a clear percentage so there’s clarity and transparency. To boost equitable distribution, women entrepreneurs can be given preference as well.

The Government should also increase the percentage of purchases through CPSUs as there would now be an increase in the number of suppliers in the MSME sector. The Government should frame policies whereby a certain percentage of the purchases of companies and establishments is procured only from MSMEs.

Every coin has two sides, with the exception of the one Amitabh Bachchan used in Sholay. The move by the Government is going to have far-reaching ramifications. The coin has been tossed. Let’s hope it falls right for the benefit of retailers and wholesalers!

With Gofrugal digital solutions, MSME Retailers & Wholesalers can fall on the right side of the coin by managing their business operations with minimal staff, least skills and 100% accurate and reliable solutions.