Key takeaways:

- Retail pricing sets product prices to attract customers and ensure profits, using concepts like markup and margin.

- Discover how a retail growth strategy helps expand market share and boost revenue by attracting new customers and building loyalty.

- Effective pricing strategies like cost-plus, competitive, and dynamic pricing help increase sales and shape brand image.

- Gofrugal’s tools aid pricing with data insights, automated adjustments, and inventory management for better profitability.

Retailers know pricing is more than just a number on a tag—it’s a daily strategic decision that affects their business's heartbeat. From setting prices before the doors open to adjusting them based on evening sales data, a pricing strategy influences every aspect of a retailer’s day. How do retailers manage this crucial aspect while handling other daily tasks?

This blog explores the key elements of effective retail pricing strategies, detailing different methods, key concepts, and real-world examples to help you integrate smart pricing into your daily routine.

Contents

- What is retail pricing?

- Why is retail pricing strategy important?

- Manufacturer suggested retail price (MSRP)

- MSRP vs. MRP

- 10 retail pricing strategies for your business

- How to choose a pricing strategy?

- Ecommerce pricing strategy vs. Pricing strategies for physical stores

- How Gofrugal can help retailers with pricing strategy

- Customer case study

What is retail pricing?

Retail pricing is the process of setting the selling price for products in a retail store. It’s a crucial part of a retailer’s overall strategy, impacting sales, profitability, and competitive positioning. This price includes the cost of the product, a markup to cover expenses, and a margin to ensure profit. It differs from other types of pricing, such as wholesale pricing, which is the price paid by retailers to suppliers or manufacturers.

Key terms in retail pricing

To understand retail pricing strategies effectively, you need to know key terms like markup, margin, elasticity, breakeven point, and several others related to pricing and profitability.

- Markup: The amount added to the cost price of a product to determine its retail price. If a product costs ₹500 and the retailer wants a 20% markup, the retail price would be ₹600.

- Margin: The percentage of the selling price that is profit. If a product is sold for ₹1,000 and the cost is ₹700, the margin is 30%.

- Elasticity: Elasticity refers to how sensitive the demand for a product is to changes in its price. Highly elastic products see significant changes in demand with small price changes, while inelastic products have stable demand regardless of price shifts. For example, luxury chocolates are highly elastic—if the price rises from ₹200 to ₹250, demand may drop sharply. In contrast, rice is inelastic; even if the price increases from ₹40 to ₹50 per kilogram, people will still buy it as it's a daily essential.

- Breakeven point: The sales amount at which the total revenue equals total costs, resulting in no profit or loss. A small grocery store in India with monthly expenses of ₹50,000 must have at least ₹50,000 in sales to break even.

- ROI (return on investment): A measure of the profitability of an investment, calculated as net profit divided by the initial cost of the investment. If a retailer invests ₹10,000 in a marketing campaign that generates ₹15,000 in profit, the ROI is 50%.

- GMROI (gross margin return on investment): A ratio that assesses a retailer's ability to turn inventory into cash above the cost of the inventory. If a retailer’s gross margin is ₹30,000 and the average inventory cost is ₹15,000, the GMROI is 2.

- Markdown: A reduction in the original selling price of a product. If a shirt initially priced at ₹1,000 is marked down to ₹700, the markdown is ₹300.

- Gatekeeper margin: The minimum margin a retailer needs to cover its costs and achieve desired profitability. If a retailer determines that it needs a gatekeeper margin of 20% to stay profitable, it ensures all products are priced accordingly.

- MRP (maximum retail price): The highest price that can be charged for a product as set by the manufacturer and printed on the product. A packaged food item has an MRP of ₹50, which is the maximum price a retailer can charge customers.

- Minimum selling price: The lowest price at which a product can be sold without incurring a loss. If a product costs ₹500 to produce, the minimum selling price might be set at ₹600 to ensure all costs and desired profit margins are covered.

- Landing cost: The total cost of a product when it arrives at the retailer, including production, shipping, customs duties, and taxes. If a product’s production cost is ₹400, and shipping and duties add ₹100, the landing cost is ₹500.

- Purchase cost: The price a retailer pays to acquire inventory from suppliers.

- Running cost: The ongoing costs of operating a business, such as rent, utilities, and wages.

- Depreciation: The reduction in the value of an asset over time due to wear and tear.

Why is retail pricing strategy important?

Retail pricing strategy is crucial as it significantly impacts sales volume and cash flow. Setting the right price attracts customers and encourages purchases, ensuring efficient cash rotation. Conversely, incorrect pricing can lead to lost sales and reduced profitability, locking up cash in unsold inventory.

The primary impact of a good pricing strategy is on cash rotation. Proper pricing ensures products move quickly, turning over inventory, and freeing up cash for reinvestment. This keeps the business liquid and able to respond to market opportunities.

Role of pricing strategies in competitive positioning

Pricing is a powerful tool for positioning a retailer in the market relative to competitors. A well-crafted retail pricing strategy can help a business stand out. For instance, a retailer using value-based pricing methods can differentiate itself by offering high perceived value, even at higher prices. On the other hand, adopting a competitive retail pricing strategy can help a store capture market share by matching or beating competitors' prices.

Influence on customer perception and behavior

Pricing significantly affects consumer perceptions of value, quality, and brand image. Strategic pricing can enhance a retailer’s reputation and influence buying decisions.

- Value perception: Pricing policies that align with perceived value can attract and retain customers. For example, offering discounts or bundle pricing can make customers feel they are getting a good deal.

- Quality perception: High prices can create an image of superior quality. Luxury brands often use premium pricing to reinforce their brand image.

- Brand image: Consistent and transparent pricing approaches can build trust and loyalty. A store known for fair and consistent prices will likely enjoy higher customer retention.

Manufacturer suggested retail price (MSRP)

The manufacturer-suggested retail price (MSRP) is an unalterable price that a manufacturer recommends the retailers use when selling their product. It is used to introduce consistency in the product pricing at different retail outlets and help maintain price integrity for the product.

Pros

- Consistency: Maintains a uniform price throughout different retail stores.

- Easy pricing: Retailers find it an easy guideline to maintain.

- Less price wars: Prevents retailers from undercutting each other.

Cons

- Inflexible: Unable to change prices as per local market needs.

- Competitive disadvantage: Loses out on price-sensitive customers due to higher prices.

Also, MSRP affects retail pricing strategies by being a benchmark. Retailers look at MSRP in sync with manufacturer expectations and industry standards.

Retailers follow MSRP to:

- Maintain brand loyalty - Maintains brand image with uniform pricing.

- Gain consumer trust - More trust from customers with similar prices.

- Unified pricing - Easier pricing decisions for retailers.

A high-value electronics retailer follows MSRP on new gadgets to maintain an exclusivity image and as reassurance to customers that they are charging fair prices.

Retailers may divert from MSRP to:

- Gain a competitive advantage - Attract customers with discounts and offers.

- Clear inventory - Clearance of old stock with discounted prices.

- Respond to a localized market: Changing prices in order to meet local demand and economic conditions.

During a festival period, a retail store might use below MSRP prices for smartphones to attract more customers and higher sales volumes.

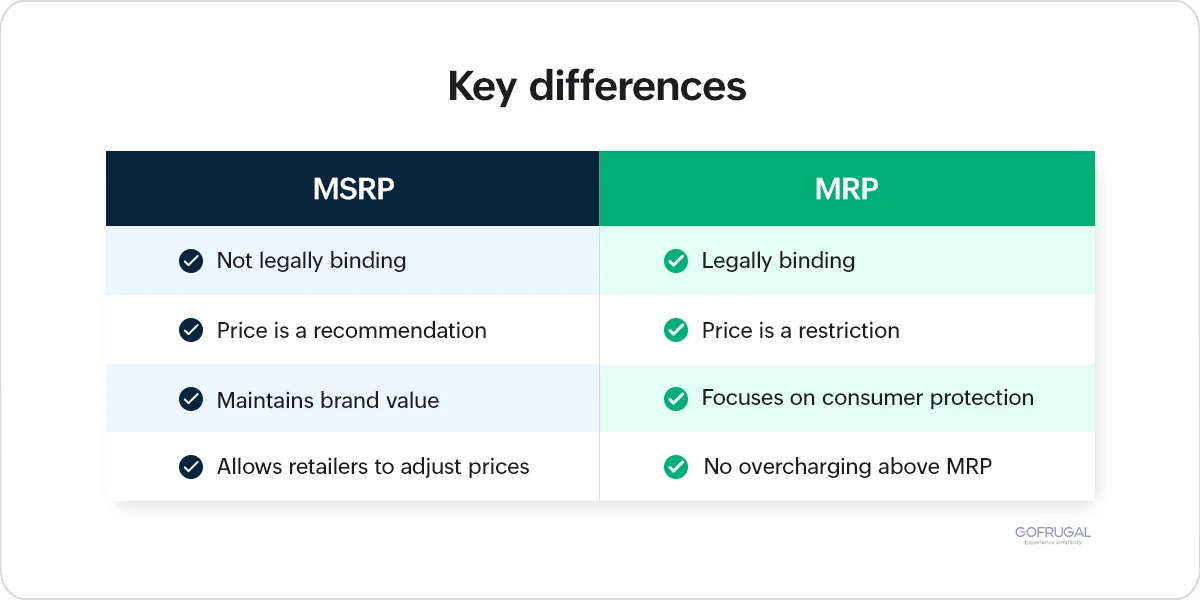

MSRP vs. MRP

MSRP and MRP (maximum retail price) are not the same, although they are similar concepts related to product pricing.

MSRP is the price a manufacturer recommends retailers charge for a product. It serves as a guideline to ensure consistent pricing across different retail outlets and is widely used in markets like the United States.

MRP is the maximum price at which a product can be sold to consumers, including all taxes. This price is set by the manufacturer and is legally enforceable. It is widely used in countries like India.

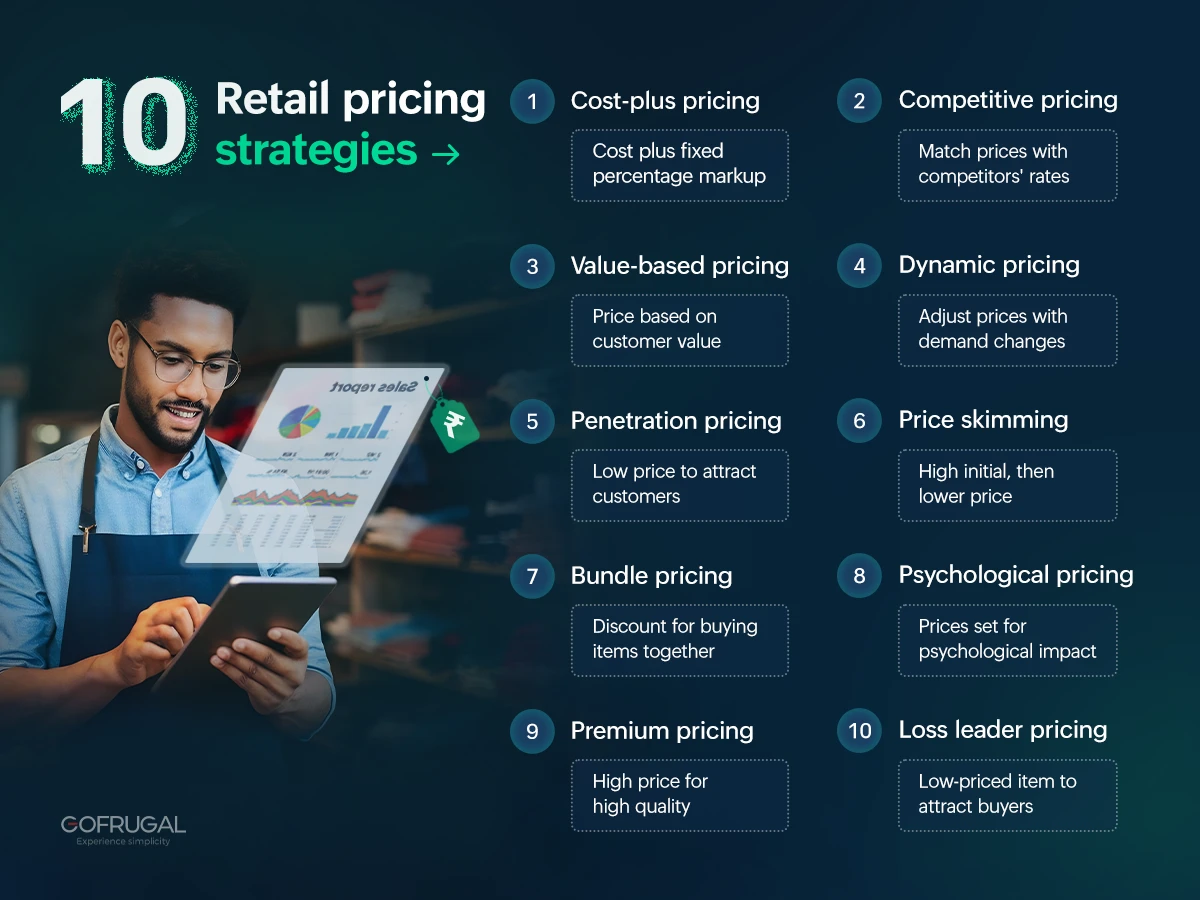

10 retail pricing strategies for business

Choosing the right retail pricing strategy is vital for attracting customers and maintaining profitability. Here’s a more detailed look at each common retail pricing approach:

1. Cost-plus pricing

Adding a fixed percentage markup to the cost of a product.

Pros:

- Simple to calculate and ensures a consistent profit margin.

- Easy to implement and understand.

Cons:

- Ignores competitor prices and customer demand.

- Doesn't encourage cost control.

Example: If a local electronics store buys a bluetooth speaker for ₹500 and adds a 20% markup, the selling price would be ₹600.

2. Competitive pricing

Setting prices based on competitors' prices.

Pros:

- Helps attract price-sensitive customers and helps you stay competitive.

- Ensures market relevance by aligning with competitor prices.

Cons:

- This can lead to price wars and reduced profit margins.

- Lacks differentiation, potentially undermines brand value.

Example: A retail store might price a popular smartphone at ₹20,000 if a nearby competitor offers the same model for ₹20,500.

3. Value-based pricing

Setting prices based on the perceived value to the customer.

Pros:

- Can command higher prices if customers perceive high value.

- Enhances customer satisfaction by aligning prices with perceived benefits.

Cons:

- Requires a deep understanding of customer perceptions and preferences.

- Risk of mispricing if the perceived value is misjudged.

Example: A premium coffee brand might charge ₹500 for a speciality coffee that customers perceive as high quality and exclusive.

4. Dynamic pricing

Adjusting prices in real-time based on demand and supply conditions.

Pros:

- Maximizes revenue by capturing varying customer willingness to pay.

- Responds quickly to market changes with real-time adjustments.

Cons:

- Requires advanced technology and sophisticated software.

- This can lead to customer dissatisfaction if frequent price changes are not managed well.

Example: Airline ticket prices that fluctuate based on demand, departure time, and remaining seats.

5. Penetration pricing

Setting a low price to enter a competitive market and attract customers quickly.

Pros:

- Quickly builds market share by attracting many customers.

- Discourages competition by setting a low price point.

Cons:

- This may result in initial losses due to low prices.

- Difficult to increase prices later once customers are accustomed to lower prices.

Example: A new online streaming service offering subscriptions at ₹99 per month to attract users from established services.

6. Price skimming

Setting a high price initially and lowering it over time.

Pros:

- Maximizes profits from early adopters who are willing to pay a premium.

- Signals high quality and innovation, enhancing brand perception.

Cons:

- May alienate price-sensitive customers initially.

- Requires strong brand recognition and perceived value.

Example: A new smartphone launched at ₹60,000, with the price gradually reduced over the following six months.

7. Bundle pricing

Selling multiple products together at a lower price than if sold separately.

Pros:

- Increases sales of related products by offering a perceived deal.

- Enhances perceived value and convenience for customers.

Cons:

- May reduce the perceived value of individual items if bundled too frequently.

- Complex inventory management is required to track bundled and individual products.

Example: A retailer offering a bundle of a laptop, printer, and software at ₹50,000, which is cheaper than buying each item separately.

8. Psychological pricing

Setting prices that have a psychological impact, like ₹999 instead of ₹1,000.

Pros:

- Can increase sales by making prices appear lower than they are.

- Simple to implement and effective for many product types.

Cons:

- May not work in all markets or with all customer segments.

- Limited impact on high-value items where price perception differs.

Example: Pricing a t-shirt at ₹499 instead of ₹500 to make it seem more affordable.

9. Premium pricing

Setting a high price to signal high quality or exclusivity.

Pros:

- Enhances brand perception by creating an image of luxury and high quality.

- This can lead to higher margins as customers are willing to pay more for perceived value.

Cons:

- Limits a retailer's customer base to those willing to pay a premium.

- Effective only if the brand is perceived as high quality and exclusive.

Example: A luxury watch brand pricing its products at ₹100,000 to maintain an exclusive image.

10. Loss leader pricing

Setting a low price on one product to attract customers who will then buy other, higher-margin products.

Pros:

- Increases foot traffic by attracting customers with low prices.

- Boosts sales of other products as customers often buy additional items.

Cons:

- Can lead to losses if customers only buy the loss leader.

- Not sustainable long-term if applied to multiple products.

Example: A grocery store selling milk at ₹20 (below cost) to attract customers who then buy other groceries at regular prices.

How to choose a pricing strategy?

Selecting the right retail pricing strategy is crucial for your business growth. Here are some ways to identify the best pricing strategy for your business.

- Analyze market conditions: Understand the competitive landscape, market demand, and economic conditions. For example, in a highly competitive market, a competitive pricing strategy might be most effective.

- Evaluate cost structure: Consider your costs, including production, shipping, and overhead. Cost-plus pricing ensures you cover costs and make a profit.

- Understand customer demographics: Know your target audience’s preferences, spending habits, and price sensitivity. Value-based pricing works well if customers perceive high value in your product.

- Consider product lifecycle: Adjust pricing based on the product’s stage in its lifecycle. Price skimming can be effective for new, innovative products, while penetration pricing is suitable for market entry.

Factors influencing retail pricing

Internal factors

- Costs: Including production, distribution, and marketing expenses. Accurate cost analysis helps set prices that cover expenses and ensure profitability.

- Business goals: Determine whether your focus is on market penetration, profit maximization, or brand positioning. Your goals influence your pricing strategy.

- Product attributes: Unique features, quality, and brand reputation can justify higher prices.

External factors

- Competition: Analyze competitors’ pricing strategies to position your prices competitively.

- Economic conditions: Consider the overall economic environment, including inflation rates and consumer spending power.

- Customer demand: Understand customer needs and demand elasticity. Elasticity affects how changes in price impact sales volume.

- Taxes and tariffs: Factor in any applicable taxes and tariffs that can affect pricing.

Achieving optimal pricing involves balancing internal and external factors. For example, while keeping costs low and competitive, your pricing can attract customers, ensuring your prices reflect the product’s value and quality to maintain brand reputation and profitability.

Ecommerce pricing strategy vs. Pricing strategies for physical stores

Retail pricing strategies vary significantly between ecommerce and physical stores. Understanding these differences is crucial for developing effective retail pricing policies.

Online shopping behavior

- Customers can easily compare prices across multiple websites, making them more price-sensitive.

- Online reviews and ratings heavily influence purchasing decisions.

- Convenience is a major factor; customers often seek the best deals without leaving their homes.

In-store shopping behavior

- Customers value the tactile experience of seeing and touching products before buying.

- Immediate availability can make customers less price-sensitive.

- The shopping experience, including store ambience and customer service, plays a significant role.

Ecommerce offers greater flexibility and rapid price adjustments compared to physical stores. Here’s how that's done.

- Dynamic pricing: Ecommerce platforms can adjust prices in real-time based on demand, competition, and inventory levels. This retail pricing approach allows for maximizing sales and profits by responding quickly to market changes.

- Algorithm-driven pricing: Ecommerce businesses use algorithms and data analytics to set optimal prices. These algorithms consider various factors like competitor prices, customer browsing behavior, and purchasing history.

Also, ecommerce businesses can quickly compare prices with competitors, allowing them to remain competitive in real-time. This capability is a significant advantage over physical stores, where price adjustments are less frequent and more cumbersome.

- Price monitoring tools: Online retailers use automated tools to track competitor prices and adjust their own prices accordingly. This competitive pricing retail strategy ensures they offer the best deals to attract customers.

- Data analytics: Ecommerce platforms leverage data analytics to gain insights into customer behavior, which helps in setting prices that maximize sales and customer satisfaction.

How Gofrugal can help retailers with pricing strategy

Gofrugal provides comprehensive solutions for effective retail pricing strategies, enhancing business performance through advanced technology.

- Data-driven decision-making: Utilize powerful data analytics tools to analyze sales, market trends, and customer behavior for informed pricing strategies.

- Automated pricing adjustments:Automate pricing based on predefined rules and real-time data to stay competitive and respond quickly to market changes.

- Customer insights and segmentation: Analyze customer data to understand purchasing patterns and tailor pricing strategies for different segments.

- Inventory management:Track inventory levels to reduce overstock and stockouts, aligning pricing with inventory status to support turnover and profitability.

- Flexible pricing modules: Implement various pricing strategies, such as dynamic, promotional, and discount pricing, easily switching as needed.

- Integrated POS system: Ensure seamless pricing across all sales channels, maintaining consistent retail pricing policies in-store and online.

- Reporting and insights: Access detailed reports on sales performance, customer behavior, and market trends to refine pricing strategies and achieve better results.

A multi-outlet retail store optimizes billing and inventory seamlessly with Gofrugal

One of our long-term customers scaled from e-commerce to a thriving multistore chain with Gofrugal! They share how Gofrugal simplified inventory management, sales tracking, and GST compliance for their pooja shopping business.

Selecting the most suitable retail pricing strategy is fundamental to the entire customer acquisition process, as well as to generating sales and becoming profitable. Each one of the strategies has its own implications, and very much depends on the market condition. You also have to consider customer profiles and the business objective when considering which one to employ.

By understanding and using these retail pricing strategies, retailers can maximize their pricing methodologies and optimize their competitive advantage. Gofrugal offers an integrated approach and intelligence to help the retailer design and adapt appropriate pricing strategies to be competitive and profitable in a dynamic market situation.