The easiest things in life seem the most difficult. GSTR-1 return filing, for instance. It may be a 2-decade long effort to get the tax implemented. Yet, filing it just 2-minute work. It may sound Greek and Latin to many. But it’s as easy as your mother tongue. Gofrugal makes this possible. This blog will tell you how!

What is GSTR-1 (Goods and services Tax Returns-1)?

Whenever a sale (outward supply of goods) or service is made by a GST registered retailer / distributor / manufacturer, the tax amount involved has to be notified to the Government of India (GOI), either monthly or quarterly. GSTR-1 return filing is a way of letting GOI and the GST registered buyer know about the tax collected. The word ‘returns’ in GSTR may make you think you will get a sum in return. Not really.

How does the GSTR-1 returns work?

Let’s assume Arvind Stores (retailer) purchases good worth of Rs. 1,00,000 (exclusive of 5% GST) from Ashok Enterprises (distributor). Now, Ashok Enterprises will file GSTR-1 stating that Rs. 5,000 (5% of invoice amount) was charged as GST on Arvind Stores for a specific invoice.

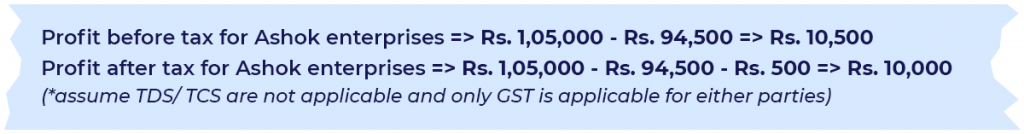

Since Ashok Enterprises is a distributor, they should have bought the goods from a manufacturer. Let’s assume, the goods were bought for Rs. 90,000 (exclusive of 5% GST, i.e., Rs. 4,500). Ashok Enterprises will pay Net GST of Rs. 500 to the Government.

GST paid during purchase (Rs. 4,500) gets returned from the GST collected during sale (Rs. 5,000) of the same goods. However, the difference of amount Rs. 500 becomes the GST payable on profit earned.

Note: The invoice with amount Rs. 90,000 will be filed by the manufacturer as GSTR-1, which can be downloaded as GSTR-2A, for reference, by Ashok Enterprises. Also, only after Ashok Enterprises file GSTR-3B, they’d be able to pay Rs. 500 as GST to GOI for this particular invoice

What is the due date to file GSTR-1?

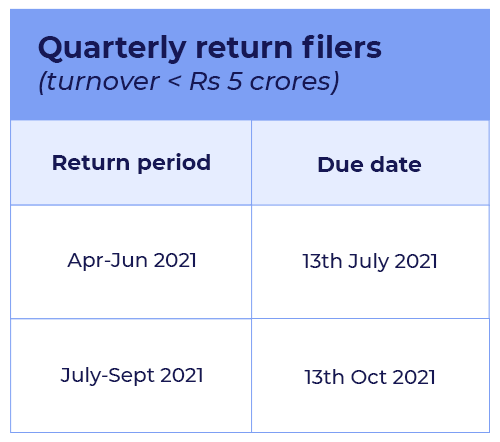

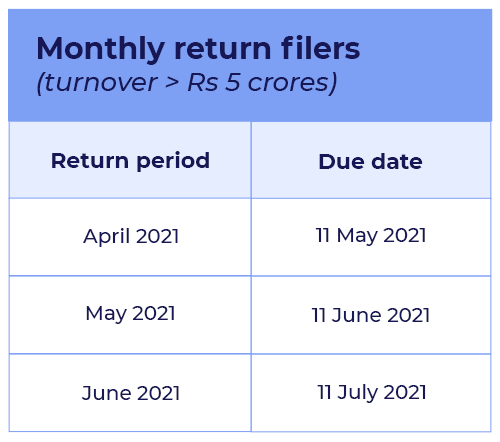

The GSTR-1 due date varies with respect to turnover made by businesses. Since January 1st 2021, small tax payers whose turnover is less than Rs. 5 crores can file GSTR-1 returns quarterly (due date to file GSTR-1 is 13th of the month following the quarter). Tax payers whose turnover is more than Rs. 5 crores should file GSTR-1 returns monthly (due date to file GSTR-1 is 11th of the succeeding month).

Is there a fee for late payment?

As per the 43rd GST council meeting, a late fee of Rs 200 per day (Rs. 100 each for CGST and SGST) will be charged if GSTR-1 return is not filed before the due date. However, the maximum late fee charged varies with respect to turnover made in the preceding financial year. If a business makes a turnover ranging between Rs.1.5 crore and Rs.5 crore, then a maximum late fee of Rs.5,000 per return (Rs. 2,500 each for CGST and SGST) will be charged. If the turnover is more than Rs.5 crore, then a maximum late fee of Rs.10,000 (i.e., Rs. 5000 per CGST and SGST) will be charged.

How can Gofrugal help prepare GSTR-1 returns in the prescribed format?

One needs a patient mind and a big heart to accept the ‘n’ number of accusations by a mere internet bot in the GST portal while GSTR-1 return filing. Many times, the bot can’t be blamed, since the error may be on the part of the filer.

- Non-filing of outward supply invoice with correct invoice details

- Claiming wrong input tax credit

- Disclosing and paying under a wrong GST head

- Unaware of proper procedures about reverse-charge mechanism

- Neglecting new GST amendments and so on

To err is human, especially when there is a large chunk of data. To forgive and correct them is what Gofrugal does. Its smart bot, supported by an efficient ERP, ensures no errors and tension; making you feel divine!

Being an authorized GST Suvidha Provider, Gofrugal implements the GST updates then and there in the weekly releases. When outward supplies such as sales and services happen, they are recorded right in the ERP software thus making the GSTR-1 return filing as easy as ABC.

Here’s the 3-step GSTR-1 filling :

1. One click is all it takes to download the GSTR-1 .CSV format for the month / quarter from Gofrugal’s tax filing web app

2. GSTR-1 has to be filed in .JSON format to the GST portal. Hence, the .CSV format file has to be converted to .JSON format using the Government GST offline tool. The CSV file has to be uploaded section by section into the offline tool, namely, HSN summary, B2B outward supplies, B2CL outward supplies, exported supplies, B2CS outward supplies, credit debit note (registered and unregistered supplies), Nil rated supplies, advances received and adjustment of advances

3. Upload the GSTR-1 returns .JSON file to the Official Government Portal as one single file to the GST portal

‘More data can be handled with less effort thanks to Gofrugal’ is the common phrase retailers, restaurateurs and distributors say about their GST return filing experience with Gofrugal.

You can too! Click the button below and register.