As a government authorized GST Suvidha Provider, we have been releasing regular updates to ensure that our customers file their GST returns on time. In the last 2 months, there has been over 10 updates from in GOFRUGAL Retail POS. Here are some quick recap of some of the major updates.

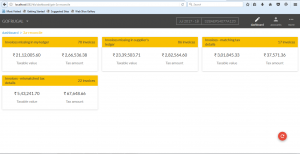

GSTR3B Filing

GSTR3B is a declaration of the summary of your inward and outward supplies for the months of July and August. With this update, GSTR3B filing can be done within 5 minutes.

For the video on GSTR3B filing, click here

GSTR1 Filing

GSTR1 is a summary of all the outward supplies which consists of sections that need to be filed separately. This update gives a very simple 3 step process to file your GSTR1.

For knowing in-depth about our GSTR 1 filing with RPOS 7, click here

For videos on GSTR 1 filing, click here

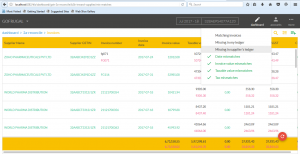

GSTR2 return report

Using the report, you can view all the details of your purchase transactions which will in turn speed up the settlement process.

GSTR 2 return report contains details of all the purchases transactions of a registered dealer for a month. GSTR2 can be filed by doing buyer-seller settlement. Buyer-seller settlement or invoice matching or is a process of matching taxable sales by the seller with the taxable purchases of the buyer. This is because GST on purchases will only be available if the details of purchases filed in GSTR-2 return of buyer matches with the details of sales filed in GSTR-1 of the seller.

Calculate GST Tax for Other Charges in Purchase

Other charges are charges like freight charges, packing charges, postage charges, etc. With this update you will be able to calculate GST on other charges in purchase.

For the video, click here

Reverse tax calculation in purchase

Reverse charge is a mechanism where the recipient of the goods and/or services has to pay GST instead of the supplier. This update lets you calculate reverse charges in a fast and simple manner.

For the video on reverse charge calculations in purchase, click here.

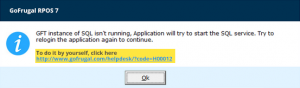

Added E-message box with Self help video links

When you are stuck with an error message popping up, the e-message box will have all the relevant self help videos for that screen. This can make it very simple for you to get help for the relevant screen.

Purchase return without selecting distributor in GST mode

In this update, purchase returns can be simplified greatly by directly doing it from the billing screen. This means, you can accept returns even by scanning barcodes.

For the video on purchase returns without selecting the distributor, click here.